How to record Capital brought into the Business in Tally.ERP 9?

In Tally.ERP 9 Accounting Software we can record the Funds flew into the Company while starting the Business. Capital Brought into the firm will be recorded using either Receipt Voucher Type or Journal Voucher in Tally. Both are correct but here we are showing you in different way to pass Capital transaction using the Journal Voucher Type.

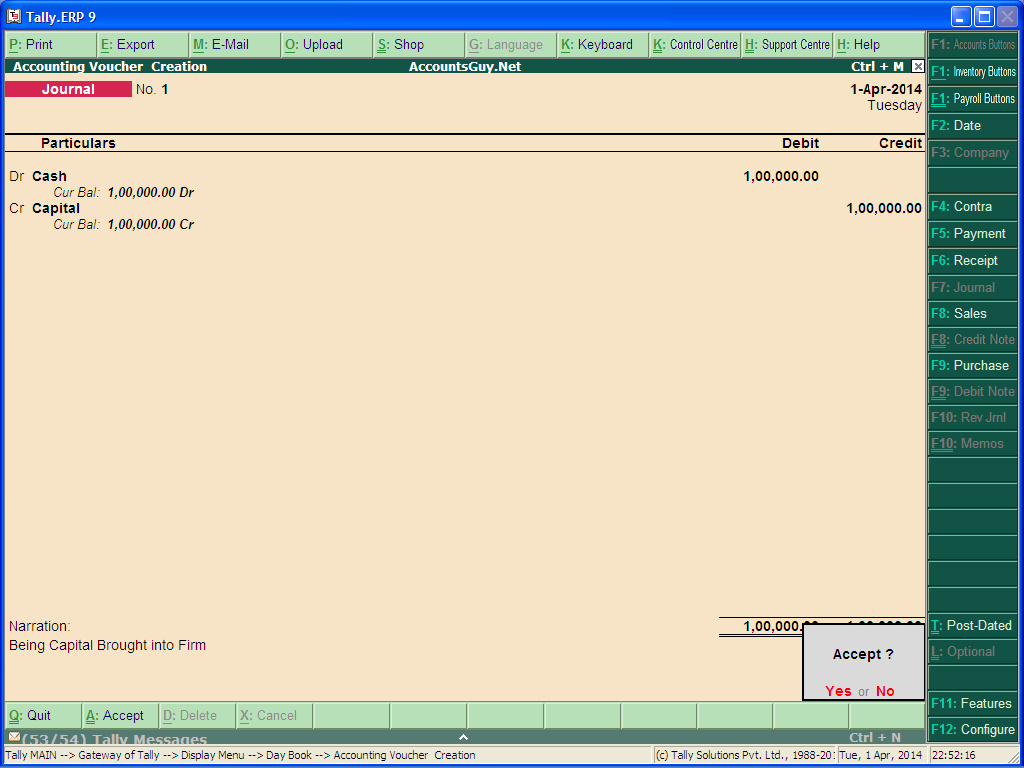

Every business starts its accounts by passing the Capital brought into the business for purchasing the Assets, Goods, and for paying off the day to day business expenses, if it is a newly started business. And this is the Voucher entry that will be passed in the Books of Accounts. Here, we have created a Company named AccountsGuy.Net in Tally.ERP 9 the proprietor of the firm has brought a initial capital of Rs.1,00,000/- in Cash.

As the Capital is not Traded Receipt, hence it can be recorded using the Journal Voucher Type which is the one of the Accounting Voucher Types in Tally. There are few more transactions like Depreciation, VAT Adjustment, which can only be recorded in Tally.ERP 9 using the Journal Voucher Type.

For recording the Cash brought as capital first we must load the Company and after that

- Select Accounting Vouchers option under Transaction in Gateway of Tally screen.

- In the Accounting Voucher Creation screen you can see the type of the Voucher opened.

- To change the Voucher Type to Journal Voucher Type either select the F7: Journal button available in the Button Area or press F7 Key using the Keyboard.

If you want to allow the Cash or Bank ledgers in the Journal press F12 in the Accounting Voucher Creation screen, set YES for Allow Cash Accounts in Journals option.

December 1, 2014 @ 4:22 AM

What about a running business? Do they need a capital account if started using Tally ?

December 1, 2014 @ 8:20 AM

Dear Husain Saifuddin,

If you have started Accounting your Running Business in Tally Accounting Software in the middle of the year, you have to create a Capital Account Ledger and just provide the Opening Balance of the Capital Account as on the first day of the Fiscal Year.

For Capital Ledger create read this article: How to create Capital Ledger Account in Tally?

April 1, 2016 @ 2:29 PM

You can create Separate Sales Voucher Types for that.

April 1, 2016 @ 2:27 PM

i am operating mobile & It business , how to create sales of IT & Mobile sales separately

April 28, 2016 @ 5:50 AM

I want to record capital introduced as stock (not cash)

What can i do?

April 28, 2016 @ 6:10 AM

Debit the Purchases Account and Credit the Capital Account.

June 8, 2016 @ 4:49 AM

If stock introduced as capital how to pass the journal entry in tally?

June 8, 2016 @ 4:50 AM

Read this Comment

December 10, 2016 @ 3:51 PM

how can i change capital amount? i tally relects 2,000,000 capital but the total money spent initially for stocks,equipments and expenses amounted only 1,700,000+

December 10, 2016 @ 3:56 PM

Using the Ledger Alteration you can change opening Balance of the Capital Account. As well you can use the Payment Voucher for recording the above cited expenses and purchases.

December 12, 2016 @ 8:38 AM

Contact me @ kshyam24@gmail.com

December 12, 2016 @ 8:36 AM

Hi i am working in Oman, my company run by an Indian he wants to install tally here in his company, if we bought tally from india will work here or we need to purchase from here (expensive than indian) please advice

December 26, 2016 @ 8:21 AM

Same entry as explained in this article.

December 26, 2016 @ 8:17 AM

hi, my company is running and company want to invest further capital in cash…kindly explain how do i enter further capital in running business

January 12, 2017 @ 4:14 PM

Hello sir, I have doubt I am taking care of Rent income and expenses in company it is new company i am a fresher to real estate records, how to record security deposit received from each flat, one point is I don't know whether the tenants going to stay in the flats for a year or more

Now I have treated transactions in tally like this

Cash Dr

To security deposit flat #123

I have created separate security deposit group under liability side in tally

January 12, 2017 @ 4:19 PM

What you did is absolutely correct as in your case. But is advisable to use the Tenant Ledger instead of Security Deposit Flat # 123. In narration you may write the Deposit for which Flat or you may use Cost Center.

January 18, 2017 @ 4:28 AM

how can i put capital amount of 4 directors . have to take that money for expenditure also.

please help me

January 18, 2017 @ 4:36 AM

Hi Bhuvana R,

You can create as many Capital Account as you need in Tally.ERP 9. Once the Capital brought into the firm it can be used by any means by the Firm, or Business.

January 18, 2017 @ 7:57 AM

I have created the capital accounts. but for expenditure there is no cash showing in it.

January 18, 2017 @ 8:05 AM

First you need to bring the Cash into firm so that you can use the Cash Balance for the payments of the expenditure.

January 30, 2017 @ 8:12 AM

Hello Sir,

How can I view the delivery note which is already created in tally ERP9

January 30, 2017 @ 8:17 AM

In order to view the list of the Delivery Note entries you need to open the "Statistics" from "Statements of Account" menu. In the Statistics report just open the "Delivery Note" then you can see the monthly summary of the Delivery Notes. Just open the month then you can see the entries.

January 31, 2017 @ 10:40 AM

how to get bill details while entering receipts and payments in tally. no bill numbers is getting populated

January 31, 2017 @ 10:42 AM

For that you need to enable the "Bill Wise details" option in the Ledger Creation screen.

February 2, 2017 @ 1:37 PM

hello sir, we are having two companies.I have uploaded one company's data in tally currently. file name of both the company's data are same.so we lost on company's full data. how can i recover it

February 2, 2017 @ 1:49 PM

Mail your complete detailed query and the Company Data Files to advice@accountsguy.net

February 5, 2017 @ 11:50 AM

Dear sir,how should I show the money which I used to buy an existing firm as a part of investment.

February 5, 2017 @ 11:52 AM

You have to show the investment in the existing Firm under the Investments (Assets side).

February 8, 2017 @ 5:36 AM

Dear sir, booked IRCTC ticket from company bank account. got cancelled . amount credited to bank account itself. how to post this tally

February 8, 2017 @ 5:38 AM

Just record the Receipt or Journal entry by reversing the Payment entry.

February 10, 2017 @ 1:10 PM

hi we just bought tally latest version, kindly let me know how to make partners' capital accounts in tally and inverntoy FIFO/LIFO metgods

February 10, 2017 @ 1:14 PM

I have written Capital Account Creation article. Just go through it. In the Stock Item Creation screen you can set LIFO or FIFO method. Search in my blog for Stock Item creation in Tally.ERP 9.

Still need any assistance mail us to advice@accountsguy.net

February 14, 2017 @ 4:35 AM

For inventory I did get you clearly. But for capital account, maybe I didn't put in clear. I meant partnership accounts. How do you categorically segment partners capital accounts with adjustable transactions; salaries and other remunerations

February 14, 2017 @ 4:41 AM

Debit the Salaries, Remuneration and Credit the respective capital accounts.

February 17, 2017 @ 5:11 PM

Dear sir,how should I show the money which I used to buy an existing firm as a part of investment.

February 17, 2017 @ 5:11 PM

Dear sir,how should I show the money used for buying am existing firm as a part of investment,in tally erp 9

Secondly how to show the shares of each partner in a company,so that profit and loss are automatically depicted

March 11, 2017 @ 12:06 PM

Hi sir While taking Profit & loss statement Salary details not getting displayed. pls let me know the configuration.

March 11, 2017 @ 12:08 PM

See under which Group you created the Salary Ledger.

April 10, 2017 @ 4:36 PM

Sir please send me any small business tally data file for study .

My email id : chimanpure.pappu@gmail.com

April 10, 2017 @ 4:39 PM

Mr Pappu Chimanpure,

It is not possible to send data file of a company it is advisable to contact a local auditor ask him that you are ready to do some accounts for free of cost and you want to get experience.

May 3, 2017 @ 4:59 AM

You can pass the Loan Processing Fee using either the Payment Voucher or Journal Voucher in Tally.ERP 9 and the Account Head shall be the Indirect Expenses.

May 3, 2017 @ 4:52 AM

Dear sir..

Plz help me how to pass loan processing fees in tally and under which group create this account …

June 10, 2017 @ 5:04 AM

Dear sir I'm about to work in a new bread factory as an accountant no training yet Confused company started 2 years ago but tally has not yet been started so I'm beginning a/c no idea of capital investment so can I use new a/c without putting capital a/c by purchased raw material sales, equipment sales returned… By this month

June 10, 2017 @ 5:09 AM

Mr. Rome Nius,

Start a new Company in Tally.ERP 9, and take the Opening Balances as shown in the Statements submitted to the Income Tax Dept., and record the transactions upto now from the beginning of the year.

If still having any doubt contact me on advice@accountsguy.net

July 14, 2017 @ 10:18 AM

I HAVE CONVERTED MY PVT CO. INTO AN LLP AND THE SHARE CAPITAL OF THE COMPANY WILL BE THE CAPITAL INTRODUCED BY THREE PARTNERS SUPPOSE A,b, c , THEN WHAT WILL BE THE TALLY ENTRY IN LLP FOR CAPITAL

July 14, 2017 @ 10:19 AM

Create ledger under Capital Group provide the opening balances.

December 24, 2017 @ 7:55 PM

WHAT IS THE ENTRY IF OWNER INVEST CAPITAL IN CHEQUE

December 27, 2017 @ 10:32 AM

If the Capital into the business is brought by the owner through bank transfer from his Savings Account to his Business Bank Account then the entry is as follows.

January 28, 2018 @ 7:40 PM

Bank a/c dr

To capital A/c

February 8, 2018 @ 11:19 PM

Dr sir, i am running a firm and yrealy turnover is aroud 3lacks,

Now, i decided to telly my transections, so what shoud be my capatil?

February 22, 2018 @ 9:55 PM

For any auditing and accounting assistance mail us your details with your contact number to advice@accoutnsguy.net, one of our team will be in touch with you.